The New Mortgage rules that have been changed from the Federal Gov’t is a game changer for affordability, especially for first time home buyers who have no equity to put towards their first home. This new rule will really hurt single parents and anyone trying to get their first home.

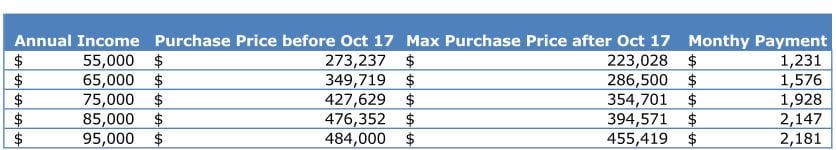

In an eggshell if you have less than 20% down you will have to qualify for a mortgage at the Bank of Canada Posted rates which are about 4.64% instead of rates that range from 2.2 to 2.7% for a 5 year term. That will really erode first time home buyers ability to qualify for the home that meets their needs. Take a look at this comparison chart we have prepared. It uses a mortgage rate of 2.7% before Oct. 17th compared to 4.6% after. If you make $50,000 per year under the new mortgage rules you will qualify for $50,000 less of a home or maybe no home at all!

With out a doubt this will affect the economy as more first time home buyers are forced out of the market. They will have to continue to waste money on rent or continue to live with their parents.

The new mortgage rules will hurt first time home market which will also hurt the move up market as there are fewer buyers that are in the market to buy their homes so that they can sell and move up.

It will affect the economy as fewer new homes will need to be built, as the demand will not be there. So there will be more unemployment as plumbers, framers, electricians, sales people, real estate lawyers etc have less work.

There will also be fewer appliances, furniture, home decorating and improvement products sold.

With next to no notice that this rule was changing, it will really hurt new home builders and especially large condo projects who have homes under construction.

What can you do if you have been wanting to buy a home and you do not have the 20% down?

- You can find a home, and get it under contract with condition removal by October 17.

- Save up until you have 20% down

- Have a co-signer so that you can qualify for more money.

Will this affect foreign investors? They probably have the 20% down, so not likely.

If you want to read the full article follow the link below.

If you want us to help you find a home in a hurry please call we will be available to help you.

[cs_contact_page]